Longevity Investor Network 2023 End of Year Update

- Two hundred investors are part of our network.

The Longevity Investor Network has experienced significant growth and success over the past year. Our mission to connect innovative companies in the longevity sector with forward-thinking investors has seen remarkable achievements, particularly in 2023.

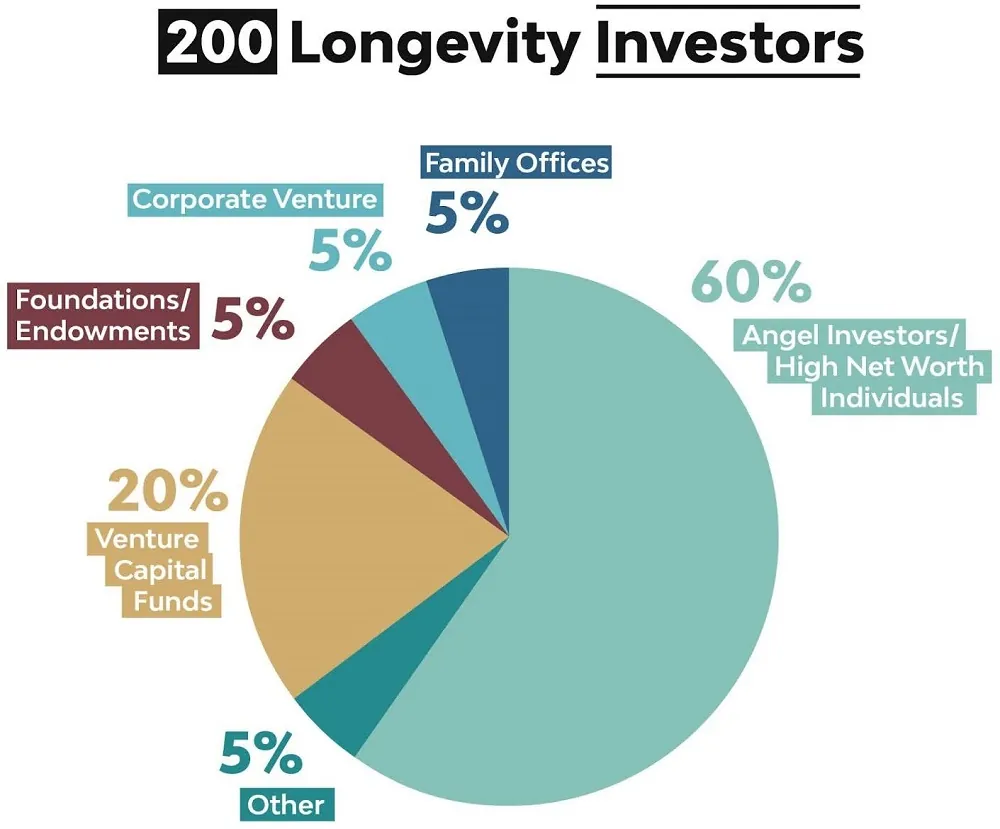

Investors

On the investor side, we have now over 200 longevity investors that form part of our robust network. Our investor community is comprised of a mixture of:

- Angel Investors / High Net Worth Individuals (60%)

- Family Offices (5%)

- Venture Capital Funds (20%)

- Corporate Venture (5%)

- Foundations / Endowments (5%)

- Other (5%)

While our focus in previous years had been on growing our Angel Investor membership, we have now begun to focus on other member profiles that can add a different perspective to our collective investment philosophy. Looking towards 2024, we are still focused on serving our key demographic of high net worth individuals & angel investors, and we are looking to form key collaborations with other institutional funders that are keen to dive into the longevity sector.

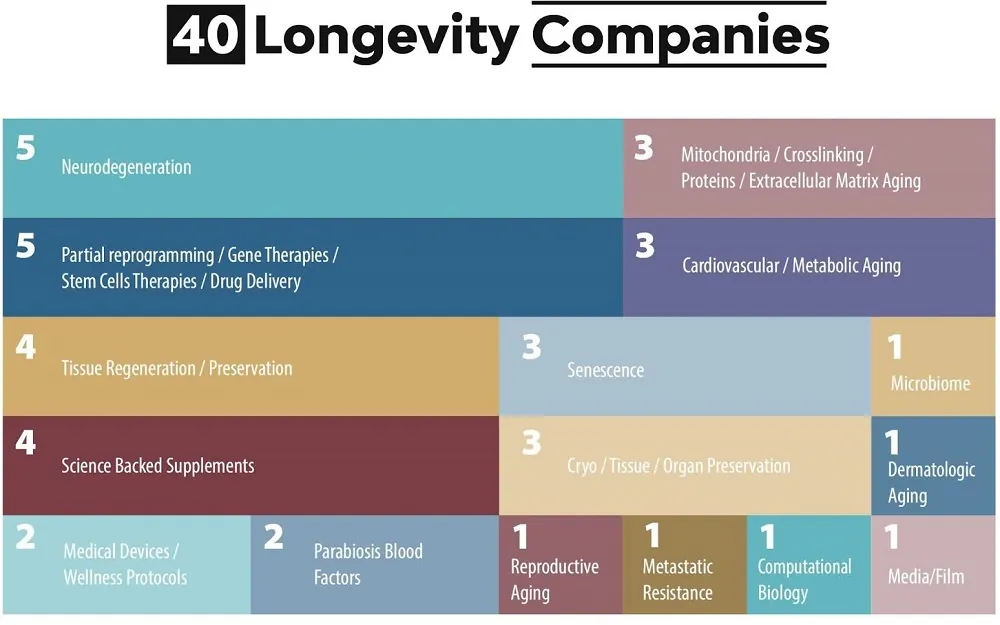

Companies

On the company side, we had 40 longevity companies pitch to our group this year. We saw several new rejuvenation areas begin to be explored and some of the more traditional areas with new approaches as well. The breakdown for this year was:

- Mitochondria / Crosslinking / Proteins / Extracellular Matrix Aging: 3 Companies

- Cardiovascular / Metabolic Aging: 3 Companies

- Medical Devices / Wellness Protocols:2 Companies

- Senescence: 3 Companies

- Computational Biology: CatHealth

- Tissue Regeneration / Preservation: 4 Companies

- Media / Film: 1 Company

- Cryo / Tissue / Organ Preservation: 3 Companies

- Reproductive Aging: 1 Company

- Parabiosis Blood Factors: 2 Companies

- Neurodegeneration: 5 Companies

- Dermatologic Aging: 1 Company

- Partial reprogramming / Gene Therapies / Stem Cells Therapies / Drug Delivery: 5 Companies

- Microbiome: 1 Company

- Science Backed Supplements: 4 Companies

- Metastatic Resistance: 1 Company

Some companies attacked several of these areas at once, but I tried to segment the areas of focus as feasibly as I could. Nonetheless, we are seeing tremendous variety in the approaches that companies are taking to tackle traditional aging biology.

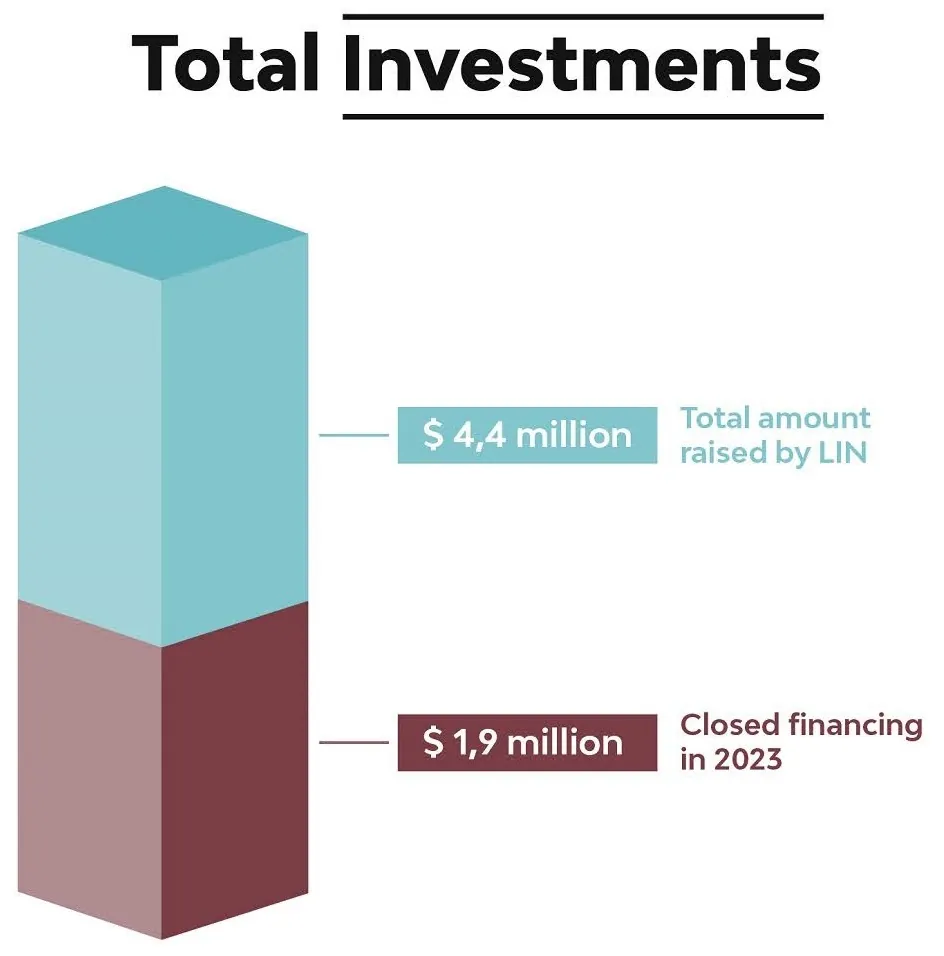

Investment

- Companies that pitched to LIN in 2023 cumulatively raised over $1.9 million in 2023 at the time of this writing and are likely to surpass $2M by year’s end with ongoing diligence proceedings and negotiations.

- This brings our total raised to date through the LIN network to over $4.4M in funds raised directed at longevity startup creation since inception.

In late 2023, we also began work on a number of new initiatives that we expect will begin to materialize more concretely in 2024. Some of those include the following:

- Slack community for longevity investors (launched Q4 2023)

- Improved tracking of portfolio companies and investor capital deployments

- Fundraising support services and coaching for longevity startups

- Longevity Investor Network LinkedIn group / pages for professional industry updates

We have several new initiatives planned for the first half of 2024. If you are interested in connecting and learning more about the Longevity Investor Network, please reach out to me via my Linkedin or email me at javier@lifespan.io.